NOTICE OF THE 2014ANNUAL MEETINGANDPROXY STATEMENT

PITNEY BOWES INC.

WORLD HEADQUARTERS

1 ELMCROFT ROAD

STAMFORD, CONNECTICUT 06926-0700

(203) 356-5000

Annual Meeting and

Proxy Statement

To the Stockholders:

We will hold our 20142017 annual meeting of stockholders at 9:00 a.m. on Monday, May 12, 20148, 2017 at our World Headquarters in Stamford, Connecticut.the Hyatt Regency Hotel, 1800 East Putnam Avenue, Old Greenwich, Connecticut 06870. The Notice of Meeting and Proxy Statement and accompanying proxy card describe in detail the matters to be acted upon at the meeting.

It is important that your shares be represented at the meeting. Whether or not you plan to attend, please submit a proxy through one of the three convenient methods described in this proxy statement in order for your shares to be voted at the meeting. Your vote is important so please act at your first opportunity.

We have elected to furnish proxy materials and the Annual Report to Stockholders, including the Report on Form 10-K for the year ended December 31, 20132016, to many of our stockholders via the Internet pursuant to Securities and Exchange Commission rules. We urge you to review those materials as well as our proxy statement for information on our financial results and business operations over the past year. The Internet availability of our proxy materials affords us an opportunity to reduce costs while providing stockholders the information they need. On or about March 27, 2014,24, 2017, we started mailing to many of our stockholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy statement and annual report and how to submit a proxy online along with instructions on how to receive a printed copy of the proxy statement and annual report. We provided a copy of the annual meeting materials to all other stockholders by mail or through electronic delivery.

If you receive your annual meeting materials by mail, the Notice of Meeting and Proxy Statement, Annual Report to Stockholders, including the Report on Form 10-K for the year ended December 31, 20132016 and proxy card are enclosed. Whether or not you plan to attend the annual meeting in person, please mark, sign, date and return your proxy card in the enclosed prepaid envelope, or submit your proxy via telephone or the Internet, as soon as possible in order for your shares to be voted at the meeting. If you decide to attend the annual meeting and wish to change your vote, you may do so by submitting a later dated proxy or by voting in person at the annual meeting. If you received your annual meeting materials via e-mail, the e-mail contains voting instructions and links to the proxy statement and annual report on the Internet, which are also available atwww.proxyvote.com.

We look forward to seeing you at the meeting.

Michael I. Roth

Non-Executive Chairman of the Board

Stamford, Connecticut

March 27, 201424, 2017

Notice of Meeting:

The annual meeting of stockholders of Pitney Bowes Inc. will be held on Monday, May 12, 2014, at 9:00 a.m. at the company’s World Headquarters, 1 Elmcroft Road, Stamford, Connecticut 06926-0700. Directions to Pitney Bowes’ World Headquarters appear on the back cover page of the proxy statement.

Important Notice Regarding the Availability of Proxy Materials for the Stockholders Meeting to be held on May 12, 2014:

Pitney Bowes’ 2014 Proxy Statement and Annual Report to Stockholders, including the Report on Form 10-K for the year ended December 31, 2013, are available atwww.proxyvote.com.

The items of business at the annual meeting are:

Stockholders also will act on such other matters as may properly come before the meeting, including any continuation of the meeting caused by any adjournment or postponement of the meeting.

March 14, 2014 is the record date for the meeting.

This proxy statement and accompanying proxy card are first being distributed or made available via the Internet beginning on or about March 27, 2014.

Amy C. Corn

Corporate Secretary

TABLE OF CONTENTS

In this summary we highlight certain information contained elsewhere in this proxy statement. This is only a summary and does not contain all the information you should consider before you submit your proxy or vote. Please read the complete proxy statement and Annual Report on Form 10-K before you submit your proxy or vote.

Annual Meeting Information

| Time and Date: | Monday, May |

| Place: | |

| Requirements for Attendingthe | Admission ticket, which is attached to your proxy card, or Notice of Internet Availability of Proxy Materials, together with a form of valid, government-issued photo identification, such as a driver’s license. If your shares are held in the name of a bank, broker or nominee, you must present proof of your ownership as of the record date (such as bank or brokerage account statement). |

| Record Date: | March |

| Voting: | Registered stockholders as of the record date (March |

Governance Structure and Leadership RolesImportant Notice Regarding the Availability of Proxy Materials for the Stockholders Meeting to be held on May 8, 2017:

The board reappointed Michael Roth, an independent member ofPitney Bowes’ 2017 Proxy Statement and Annual Report to Stockholders, including the board of directors, to serve as Non-Executive Chairman of the Board in May 2013. A description of the Independent Chairman role appears in the Board of Directors Governance Principles, which can be found on the company’s website atwww.pb.com under the caption “Our Company—Leadership & Governance.” In December 2012, Marc Lautenbach became the company’s President and Chief Executive Officer. In his first year as President and CEO, Mr. Lautenbach focused on resetting the strategic direction of the company, assembling the right team to lead the company’s critical areas of development over the next several years and beginning to execute on initiatives consistent with the new strategies.

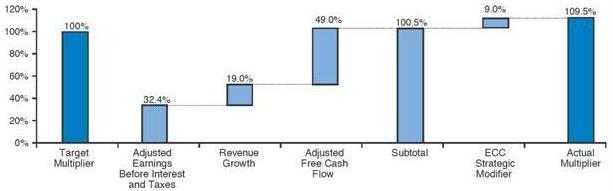

2013 Performance and Payout

SUMMARY OF 2013 BUSINESS RESULTS

In 2013, the company achieved significant success in executing on its strategy to transform the company for the future. This success was evidenced through our financial results and attainment of certain objectives targeted at longer-term success, including solidifying our balance sheet and divesting businesses no longer in line with the company’s long-term strategy. Our total shareholder return for the year was an extraordinary 132%, which placed us fifth in year-over-year total stockholder return among all S&P 500 companies for 2013. We believe the stock price increase reflected stockholder recognition that our first steps in executing on our new strategy to unlock the value embedded in our company were successful and position us well for the future.

We identified three major objectives for the company that would determine our progress towards transforming our businesses and made significant progress on each. These objectives were as follows: (1) stabilize the mailing business; (2) achieve operational excellence and (3) invest in growth initiatives.

PROXY SUMMARY

We urge stockholders to read our Annual Report on Form 10-K for the year ended December 31, 2013, filed with the Securities and Exchange Commission (SEC) on February 21, 2014, which describes our business and 2013 financial results in more detail.2016, are available atwww.proxyvote.com.

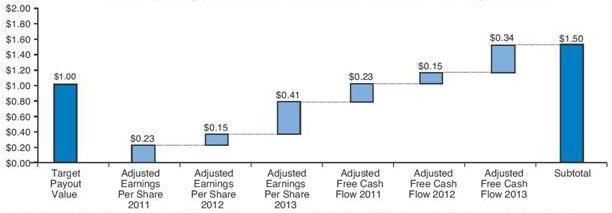

SUMMARY OF 2013 COMPENSATION PAYOUTS

Based on the 2013 financial results summarized above when compared against the pre-determined financial goals,The items of business at the annual incentive payout multiplier for the named executive officers (NEOs) was 109.5% and the long-term 2011-2013 cash incentive award payout was $1.50.meeting are:

| 1. | Election of 11 directors named in the | |

| ||

| 2. | Ratification of the Audit Committee’s Appointment of the Independent Accountants for 2017. |

| 3. | ||

| 4. | Non-binding Advisory Vote on the | |

Stockholders also will act on such other matters as may properly come before the meeting, including any adjournment or postponement of the meeting.

March 10, 2017 is the record date for the meeting.

This proxy statement and accompanying proxy card are first being distributed or made available via the Internet beginning on or about March 24, 2017.

Daniel J. Goldstein

Executive Vice President, Chief Legal Officer & Corporate Secretary

| NOTICE: Your vote is important. Brokers arenot permitted to vote on any proposals to be considered at the meeting except on proposal 2, ratification of the Audit Committee’s appointment of the Independent Accountants for 2017, without instructions from the beneficial owner. Therefore, if your shares are held through a broker, please instruct your broker, bank or other nominee on how to vote your shares. For your vote to be counted with respect to proposals 1, 3 or 4, you will need to communicate your voting decisions to your broker, bank, financial institution or other nominee. |

PROXY SUMMARY

Summary of 2013 Executive Compensation Changes

At the annual meeting in 2013, stockholders overwhelmingly approved our executive compensation (Say-on-Pay) with nearly 93% of votes cast in favor. The vote reflected stockholder approval for the compensation changes the Executive Compensation Committee adopted in late 2012 and early 2013 in connection with executive compensation. These actions included:TABLE OF CONTENTS

| The Annual Meeting and Voting | 6 | |

| 6 | ||

| Outstanding Shares and Vote Entitlement | ||

| How do I vote? | 6 | |

| May I revoke my proxy or change my vote? | 6 | |

| What constitutes a quorum? | 6 | |

| What vote is required for a proposal to pass? | 6 | |

| How are votes counted? | 7 | |

| How do Dividend Reinvestment Plan participants or employees with shares in the | 7 | |

| Who will count the votes? | 7 | |

| Want more copies of | 7 | |

| Want Electronic Delivery of the Annual Report and Proxy Statement? | 7 | |

| Stockholder Proposals and Other Business for the 2017 Annual Meeting | 8 | |

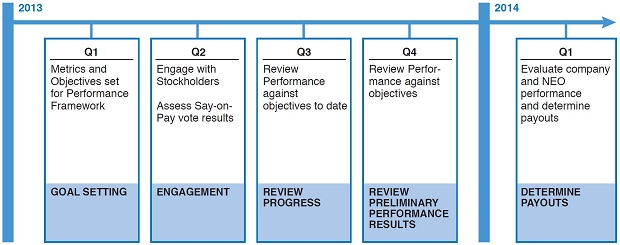

Continuing to make improvements in the executive compensation structure in 2013, the Executive Compensation Committee adopted the following changes to further strengthen the alignment of executive compensation incentives with stockholder interests:

| 3 |

We have a “pay-for-performance” philosophy that is the foundation of all decisions regarding compensation of our NEOs. With the changes approved by the Executive Compensation Committee and the independent board members, we have enhanced the link between pay and performance in the design of our executive compensation program. Please see “Compensation Discussion and Analysis” beginning on page 35 of this proxy statement for a more detailed discussion of the 2013 executive compensation awards and payouts.

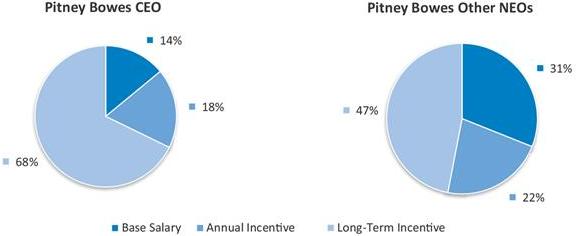

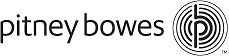

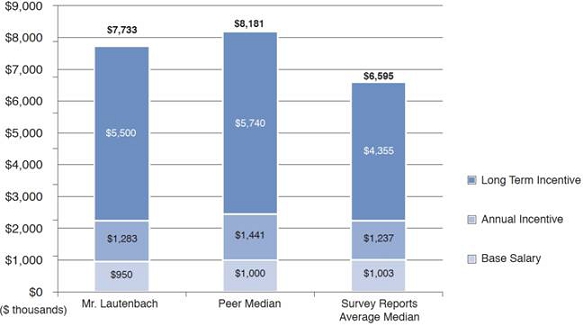

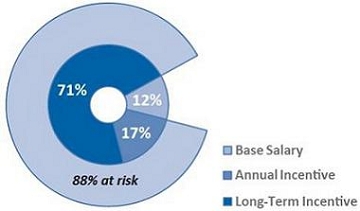

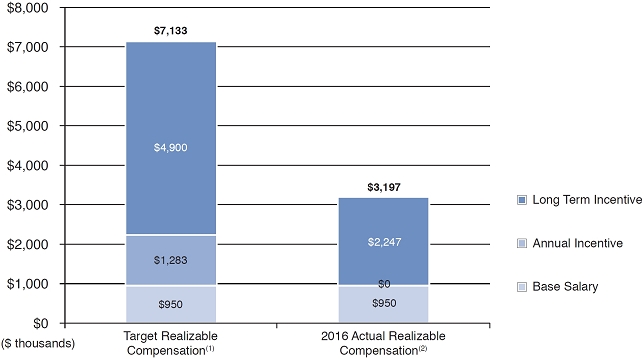

Direct Compensation Components and Mix

For each NEO, the Executive Compensation Committee sets target total direct compensation levels (base salary plus annual and long-term incentives) so that the base salary, total cash compensation, and total direct compensation is at +/– 20% of the median for each position of the competitive data based on the Towers Watson Regressed Compensation Report, as regressed for companies approximately our size, and the Radford High-Tech Industry Survey focusing on companies with revenue scopes similar to ours (Survey Reports). NEO direct compensation is weighted toward variable compensation, where the actual amount earned may vary from the targeted amounts due to company performance.

Meeting Agenda Items

Proposal 1: Election of Directors

You are being asked to elect 10 directors.eleven directors, which constitute the entire board. Each of the directorsdirector nominees is standing for election to a one-year term ending as ofat the next annual meeting of stockholders in 20152018 and until his or her successor has been duly elected and qualified.

All current directors attended overat least 75% of the meetings of the board and board committees on which they served in 2013.2016.

Summary Information about our Director NomineesThe board of directors recommends that stockholders vote FOR the election of all the director nominees.

| Director Nominee | Age | Director Since | Occupation | Independent | Committees | Other Public Boards | |||||||

| Linda G. Alvarado | 62 | 1992 | President and CEO, Alvarado Construction, Inc. | X | • Finance •Governance | 3M Company | |||||||

| Anne M. Busquet | 64 | 2007 | Principal, AMB Advisors, LLC | X | • Executive Compensation •Governance | — | |||||||

| Roger Fradin | 60 | 2012 | President and CEO, Honeywell Automation and Control Solutions, Honeywell International, Inc. | X | • Audit •Finance | MSC Industrial Direct Co., Inc. | |||||||

| Anne Sutherland Fuchs | 66 | 2005 | Consultant to private equity firms | X | • Audit • Executive Compensation | Gartner, Inc. | |||||||

| S. Douglas Hutcheson | 58 | 2012 | Former CEO, Leap Wireless International, Inc. | X | • Audit •Finance | — | |||||||

| Marc B. Lautenbach | 52 | 2012 | President and CEO, Pitney Bowes Inc. | • Executive | — | ||||||||

| Eduardo R. Menascé | 68 | 2001 | Retired President, Enterprise Solutions Group, Verizon Communications Inc. | X | • Executive •Executive Compensation** • Governance | John Wiley & Sons Inc., Hill-Rom Holdings, Inc., Hillenbrand, Inc. | |||||||

| Michael I. Roth* | 68 | 1995 | Chairman and CEO, The Interpublic Group of Companies, Inc. | X | • Audit • Executive** • Finance** | Ryman Hospitality Properties Inc., The Interpublic Group of Companies, Inc. | |||||||

| David L. Shedlarz | 65 | 2001 | Retired Vice Chairman, Pfizer Inc. | X | • Audit** •Executive • Finance | Teachers Insurance and Annuity Association, The Hershey Company | |||||||

| David B. Snow, Jr. | 59 | 2006 | Managing Partner and CEO, Cedar Gate Partners LLC | X | • Executive •Executive Compensation • Governance** | — |

PROXY SUMMARY

Proposal 2: Ratification of the Audit Committee’s Appointment of the IndependentAccountants for 20142017

The board is asking stockholders to ratify the selection of PricewaterhouseCoopers LLP as our independent accountants for 2014.2017.

The board of directors recommends that stockholders vote FOR the ratification of PricewaterhouseCoopers LLP as our independent accountants for 2017.

Proposal 3: Non-binding Advisory Vote to Approve Executive Compensation

The board is asking stockholders to approve, on ana non-binding advisory basis, the compensation of the named executive officers as disclosed in this proxy statement. The board has determined to hold this advisory vote on an annual basis. The next advisory vote will beis expected to take place at the 20152018 annual meeting of stockholders.

The board of directors recommends that stockholders vote onFOR the approval of executive compensation ison an advisory vote and the results will not be bindingbasis.

Proposal 4: Non-binding Advisory Vote on the board or Pitney Bowes Inc. The affirmative voteFrequency of the majority of the votes cast will constitute the stockholders’ non-binding approval with respectFuture Advisory Votes to our executive compensation programs. Abstentions and broker non-votes will not be votes cast and therefore will have no effect on the outcome of the vote.

Proposal 4: Approval of the Pitney Bowes Directors’ Stock PlanApprove Executive Compensation

The board is asking stockholders to approve, on an advisory basis, that the Directors’ Stock Plan. The plan will govern grants of stock-based awardsadvisory vote to non-employee directors. The plan does not require the authorization of additional shares. All awards under the Directors’ Stock Plan will be satisfied from the shares approved in 2013 in connection with the 2013 Employee Stock Plan.approve executive compensation occurs every year.

The board of directors recommends that stockholders vote to conduct future advisory votes to approve executive compensation EVERY YEAR.

Our board of directors is soliciting proxies to be used at the annual meeting of stockholders to be held on May 12, 2014,8, 2017, at 9:00 a.m. at the company’s World Headquarters, 1 Elmcroft Road, Stamford,Hyatt Regency Hotel, 1800 East Putnam Avenue, Old Greenwich, Connecticut 06870, and at any adjournment or postponement of the meeting. This proxy statement contains information about the items being voted on at the annual meeting.

An admission ticket, which is required for entry into the annual meeting, is attached to your proxy card if you hold shares directly in your name as a registered stockholder. If you plan to attend the annual meeting, please submit your proxy but keep the admission ticket and bring it to the annual meeting.

If your shares are held in the name of a bank, broker or nominee and you plan to attend the meeting, you must present proof of your ownership of Pitney Bowes stock as of the record date (such as a bank or brokerage account statement) to be admitted to the meeting.

If you have received a Notice of Internet Availability of Proxy Materials (a “Notice”), your Notice is your admission ticket. If you plan to attend the annual meeting, please submit your proxy, but keep the Notice and bring it to the annual meeting.

Stockholders also must present a form of photo identification, such as a driver’s license, in order to be admitted to the annual meeting.No cameras, recording equipment, large bags, or packages will be permitted in the annual meeting. Many cellular phones have built-in cameras, and, while these phones may be brought into the annual meeting, the camera function may not be used at any time.

Who is entitledEach stockholder may appoint only one proxy holder or representative to vote?attend the meeting on his, her or its behalf.

Record stockholdersOutstanding Shares and Vote Entitlement

Each share of Pitney Bowes common stock has one vote. In addition, we have two classes of preferred stock issued and outstanding: the 4% Preferred Stock and the $2.12 convertiblePreference Stock. The 4% Preferred Stock can be converted into 24.24 shares of common stock in certain events but does not carry any voting rights. As of March 10, 2017 (the record date), there were 12 shares of the 4% Preference Stock outstanding. The $2.12 Preference Stock can be converted into 16.53 shares of common stock in certain events and each share of the $2.12 Preference Stock carries with it 16.53 votes. Record holders of the common stock and the preference stock at the close of business on March 14, 2014 (thethe record date)date of March10, 2017 can vote at the meeting. As of the record date, 202,609,582186,280,109 shares of Pitney Bowes common stock, and 20,85317,645 shares of the $2.12 convertible preference stockPreference Stock were issued and outstanding. Each stockholder has one vote for each share of common stock owned as of the record date, and 16.53 votes for each share of $2.12 convertible preference stock owned as of the record date.

If you are a registered stockholder which means you hold shares in your name, you may choose one of three methods to grantsubmit your proxy to have your shares voted:

| • | you may | |

| • | you may | |

| • | if you received your annual meeting material by mail, you also may choose to grant your proxy by completing and mailing the proxy card. |

Alternatively, you may attend the meeting and vote in person.

If you hold your shares through a broker, bank, trustee or other nominee, you are a beneficial owner and should refer to instructions provided by that entity on voting methods. Please note that if you are a beneficial owner and you wish to vote in person at the meeting, you must first obtain a legal proxy issued in your name from the broker, bank, trustee or other nominee that holds your shares.

May I revoke my proxy or change my vote?

If you are a registered stockholder, you may revoke your proxy or change your vote at any time before your proxy is voted at the meeting by any of the following methods:

| • | you may send in a revised proxy dated later than the first proxy; | |

| • | you may vote in person at the meeting; or | |

| • | you may notify the corporate secretary in writing prior to the meeting that you have revoked your proxy. |

Attendance at the meeting alone will not revoke your proxy.

If you hold your shares through a broker, bank, trustee or other nominee, you are a beneficial owner and should refer to instructions provided by that entity on how to revoke your proxy or change your vote.

The holders of shares representing a majority of the votes entitled to be cast at the annual meeting constitutes a quorum. If you submit your proxy by Internet, telephone or proxy card, you will be considered part of the quorum. Abstentions and broker non-votes are included in the count to determine a quorum.

What vote is required for a proposal to pass?

If a quorum is present, director candidates receiving the affirmative vote of a majority of votes cast will be elected. Proposals 2, 3 and 4 will be approved if a quorum is present and a majority of the votes cast by the stockholders are voted for the proposal.

| 6 |

GENERAL INFORMATION

Your broker is not permitted to vote on your behalf on the election of directors, executive compensation and other mattersany proposals to be considered at the stockholders meeting (exceptexcept on proposal 2, the ratification of the selection of PricewaterhouseCoopers LLP as auditorsindependent accountants for 2014),2017, unless you provide specific instructions by completing and returning the voting instruction form or following the instructions provided to you to vote your stock via telephone or the Internet. If you do not own your shares of record, for your vote to be counted with respect to proposals 1, 3 or 4, you will need to communicate your voting decisions to your broker, bank, financial institution or other nominee.

Under New York Stock Exchange rules, if your broker holds your shares in its “street” name, the broker may vote your shares in its discretion on proposal 2 if it does not receive instructions from you.

GENERAL INFORMATION

If your brokerdoes nothave discretionary voting authority and you do not provide voting instructions, or if you abstain on one or more agenda items, the effect would be as follows:

Proposal 1: Election of Directors

Broker non-votes and abstentions would not be votes cast and therefore would not be counted either for or against. As a result, broker non-votes and abstentions will have no effect in the election of directors.

Proposal 2: Ratification of Audit Committee’s Appointment of the Independent Accountants for 20142016

If you choose to abstain in the ratification of the Audit Committee’s selection of the independent accountants for 2014,2017, the abstention will have no effect.effect on the ratification of the Audit Committee’s selection of the independent accountants for 2017.

Proposal 3: Non-binding Advisory Vote to Approve Executive Compensation

The vote to approve executive compensation is an advisory vote and the results will not be binding on the board of directors or the company.Company. The board of directors will review the results and take them into consideration when making future decisions regarding executive compensation. Broker non-votes and abstentions would not be votes cast and therefore would not be counted either for or against. As a result, broker non-votes and abstentions will have no effect on the advisory vote onto approve executive compensation.

Proposal 4: ApprovalNon-binding Advisory Vote on the Frequency of Future Advisory Votes to Approve Executive Compensation

The vote on the frequency of the Pitney Bowes Inc. Directors’ Stock Plan

Under our By-laws, brokervote to approve executive compensation is an advisory vote and the results will not be binding on the board of directors or the Company. The board of directors will review the results and take them into consideration when making future decisions regarding executive compensation. Broker non-votes and abstentions would not be votes cast and therefore would not be counted either for or against. As a result, broker non-votes and abstentions willwould have no effect on the vote on the Directors’ Stock Plan. However, for purposes of approval under New York Stock Exchange rules, abstentions are treated as votes cast, and, therefore, will have the same effect as an “against” vote, and broker non-votes are not considered votes cast, and, therefore, will have no effect on the outcome of the vote.this proposal.

How do Dividend Reinvestment Plan participants or employees with shares in the 401(k) plans vote by proxy?

If you are a registered stockholder and participate in our Dividend Reinvestment Plan, or our employee 401(k) plans, your proxy includes the number of shares acquired through the Dividend Reinvestment Plan and/or credited to your 401(k) plan account.

Shares held in our 401(k) plans are voted by the plan trustee in accordance with voting instructions received from plan participants. The plans direct the trustee to vote shares for which no instructions are received in the same proportion (for, against or abstain) indicated by the voting instructions given by participants in the plans.

Broadridge Financial Solutions, Inc. (Broadridge) will tabulate the votes and act as Inspector of Election.

Want more copies of the proxy statement? Getting too many copies?

Only one Notice or, if paper copies are requested, only one proxy statement and annual report to stockholders including the report on Form 10-K are delivered to

multiple stockholders sharing an address unless one or more of the stockholders give us contrary instructions. You may request to receive a separate copy of these materials, either now or in the future, and we will promptly deliver the requested materials.

Similarly, any stockholder currently sharing an address with another stockholder but nonetheless receiving separate copies of the materials may request delivery of a single copy in the future.

Requests can be made to:

Broadridge Householding Department by phone at 1-800-579-16391-866-540-7095 or by mail to:

Broadridge Householding Department

51 Mercedes Way

Edgewood, New York 11717.

If you own shares of stock through a bank, broker, trustee or other nominee and receive more than one copy of the materials, please contact that entity to eliminate duplicate mailings.

Additional copies of our annual report to stockholders, including the report on Form 10-K or the proxy statement will be sent to stockholders free of charge upon written request to:

Investor Relations, Pitney Bowes Inc.

1 Elmcroft Road, MSC 63-02

3001 Summer Street

Stamford, CT 06926-0700.

Want Electronic Delivery of the Annual Report and Proxy Statement?

We want to communicate with you in the way you prefer. You may choose to receive:

| 7 |

GENERAL INFORMATION

| • | a Notice of Internet Availability of Proxy Materials or a full set of printed materials, including the proxy statement, annual report and proxy card; or | |

| • | an email with instructions for how to view the annual meeting materials and vote online. |

DuringIf you received the voting season,Notice of Internet Availability of Proxy Materials or a full set of annual meeting materials by mail, you can select the method of delivery for themay choose to receive future annual meeting materials electronically by following the instructions when you vote online or by telephone. If you choose to receive the annual meeting materials electronically,With electronic delivery, you will receive an e-mail for future meetings listing the website locations of these documents and your choice to receive annual meeting materials electronically will remain in effect until you notify us that you wish to resume mail delivery of these documents. If you hold your Pitney Bowes stock through a bank, broker, trustee or other nominee, you should refer to the information provided by that entity for instructions on how to elect this option. This proxy statement and our 20132016 annual report may be viewed online atwww.proxyvote.com.

Stockholder Proposals and Other Business for the 20152018 Annual Meeting

If a stockholder wants to submit a proposal for inclusion in our proxy material for the 20152018 annual meeting, which is scheduled to be held on Monday, May 11, 2015,7, 2018, it must be received by the corporate secretaryCorporate Secretary by the close of business on November 27, 2014.24, 2017. Also, under our By-laws, a stockholder can present other business

at an annual meeting, including the nomination of candidates for director, only if written notice of the business or candidates is received by the corporate secretaryCorporate Secretary no earlier than the close of business on January 12, 20158, 2018 and no later than the close of business on February 11, 2015.7, 2018. However, in the event that the date of the 20152018 annual

GENERAL INFORMATION

meeting is more than 30 days before or more than 60 days after the anniversary of our 20142017 annual meeting, then the stockholder’s notice must be delivered no earlier than the close of business on the 120th day prior to the meeting and no later than the close of business on the later of the 90th day prior to the meeting or, if the first public announcement of the date of the annual meeting is less than 100 days prior to the date of such meeting, the 10th day after the first public announcement of the meeting date. There are other procedural requirements in the By-laws pertaining to stockholder proposals and director

nominations. The By-laws are posted on our Corporate Governance website atwww.pb.comwww.pitneybowes.com under the caption “Our Company—Our Leadership & Governance—Corporate Governance.” If notice of a matter is not received within the applicable deadlines or does not comply with the By-laws, the chairman of the meeting may refuse to introduce such matter. If a stockholder does not meet these deadlines, or does not satisfy the requirements of Rule 14a-4 of the Exchange Act, the persons named as proxies will be allowed to use their discretionary voting authority when and if the matter is raised at the annual meeting.

We encourage stockholders to visit our Corporate Governance website atwww.pb.comwww.pitneybowes.com under the caption “Our Company—Leadership &Meet Our Leaders—Corporate Governance” for information concerning governance practices, including the Governance Principles of the Board of Directors, charters of the committees of the board, and the directors’ Code of Business Conduct and Ethics. Our Business Practices Guidelines, which is the Code of Ethics for employees, including our Chief Executive Officer (CEO) and Chief Financial Officer,our named executive officers (NEOs), is also available on our Leadershipat “Our Company—Corporate Responsibility—Values & Governance website.Ethics.” We intend to disclose any future amendments or waivers to certain provisions of the directors’ Code of Business Conduct and Ethics or the Business Practices Guidelines on our website within four business days following the date of such amendment or waiver.

Investor Outreach.It is our practice to contact many of our stockholders over the course of the year to seek their views on various governance topics and executive compensation matters. In the spring of 2016, we reached out to stockholders representing approximately 49% of outstanding company shares, and in fall 2016, we reached out to stockholders representing approximately 51% of outstanding company shares. We value the feedback we receive concerning the board’s leadership structure, governance practices, the company’s proxy statement, and emerging governance and executive compensation. With those stockholders who responded to our invitation in the fall of 2016, we discussed corporate governance practices, executive compensation policies and our approach to the board’s role in risk mitigation oversight, including its oversight of our cybersecurity efforts. The stockholders were generally satisfied with our approach.

| 8 | |||

GENERAL INFORMATION

Key Corporate Governance Practices Enhancing the Board’s Independent

Leadership, Accountability and Oversight

| • | Separate Chairman and CEO.Our Governance Principles include well-defined responsibilities, qualifications and selection criteria with respect to the Chairman role. The board has appointed Michael I. Roth, an independent director, as Non-Executive Chairman. | ||

| • | Independent Committees.The board of directors determined that all board committees, other than the Executive Committee, should consist entirely of independent directors. | ||

| • | Executive Sessions.At each regular board meeting, our independent directors meet without the CEO or other members of management present to discuss issues, including matters concerning management. The Non-Executive Chairman presides at these executive sessions. | ||

| • | Majority Voting in Director Elections.Our By-Laws provide that in uncontested elections, director nominees must be elected by a majority of the votes cast. | ||

| • | Annual Election of Directors.Our By-Laws provide that our stockholders elect all directors annually. | ||

| • | Stock Holding Requirements.Each director is required to achieve a minimum share ownership with a market value equal to five times the annual base cash retainer for board service. The minimum ownership requirement must be achieved within the first five years of service on the board. | ||

| • | |||

| No Hedging or Pledging.Directors may not pledge or transfer for value Pitney Bowes securities, engage in short-term speculative (“in and out”) trading in Pitney Bowes securities, or participate in hedging and other derivative transactions, including short sales, “put” or “call” options, swaps, collars or similar derivative transactions, with respect to Pitney Bowes securities. | |||

| • |

Effective December 3, 2012, theThe board of directors has separated the roles of Chairman and CEO. The board appointed Michael I. Roth, an independent director, asis our Non-Executive Chairman of the board of directors andlast reappointed him to this roleby the board for an additional one-year term in May 2013 for a term of one year.2016. The board of directors believes it should have the flexibility to establish a leadership structure that works best for the company at a particular time, and it reviews that structure from time to time, including in the context of a change in leadership. The board decidedbelieves that withits current leadership structure best serves the electionobjective of Mr. Lautenbach aseffective board oversight of management at this time and allows our CEO to focus primarily on the operations and duemanagement of the company, while leveraging the experience of the Non-Executive Chairman to lead the board.

In addition to his responsibilities in chairing the meetings of the board and of the Finance Committee, Mr.

Roth, is actively involved in providing guidance to the fact that the responsibilitiesChief Executive Officer through frequent conversations, bringing to bear his experiences as a current and former CEO of public companies and his experiences from his service on other boards. He is a member of the Lead Director,Audit Committee and also regularly attends the meetings of the two committees on which

was he is not a member, Executive Compensation and Governance. Also, our CEO’s ability to confer with Mr. Roth in person is enhanced by Mr. Roth’s role priorproximity to his appointment as Non-Executive Chairman, were similar in most respects to those of a Non-Executive Chairman, this was an appropriate time to separate the roles of CEO and Chairman.company headquarters.

The board of directors has established well-defined responsibilities, qualifications and selection criteria with respect to the Chairman role. This information is set forth in detail in the Governance Principles of the Board of Directors, which can be found on our website atwww.pb.comwww.pitneybowes.com under the caption “Our Company—Leadership &Meet Our Leaders—Corporate Governance.”

| 9 |

CORPORATE GOVERNANCE

Management Succession Planning

Among the board’s most important responsibilities is to oversee short and long-term succession planning and leadership development. As part of this process, the Governance Committee oversees long-term and short-term plans for CEO succession. The board of directors is responsible for evaluating the performance of the CEO and for selection of successors to that position. The criteria used when assessing the qualifications of potential CEO successors include, among others, strategic vision and leadership, operational excellence, financial management, executive officer leadership development, ability to motivate employees, and an ability to develop an effective working relationship with the board. The Governance Principles of the

Board of Directors, which are posted on the company’s website atwww.pb.comwww.pitneybowes.comunder the caption “Our Company—Leadership &Meet Our Leaders—Corporate Governance,” include additional information about succession planning.

In late 2012, the board used the succession planning process described above to plan for the succession from our former CEO to the hiring of our new President and CEO, Mr. Lautenbach, and to the appointment of a new Non-Executive Chairman of the board, Michael I. Roth.

Periodically, but not less than annually, the board of directors considers management’s recommendations concerning succession planning for senior management roles other than the role of CEO. As part of this process, the board reviews development plans to strengthen and supplement the skills and qualifications of internal succession candidates.

Board Composition and Board Succession Planning

The Governance Committee periodically updates and reviews the skills and types of experience that should be represented on the board of directors in light of the company’s current business needs and future strategy. The Committee then compares these desired skills and experiences to those which current board members possess to determine whether all the identified skills and experience are sufficiently represented on the board. Based upon its review, and on its discussion with the CEO, the Committee may recommend to the board that additional expertise is advisable. The Committee would then develop for the board’s consideration a skills and experience profile to be used in identifying additional board candidates as appropriate.

The board believes that, in planning for board succession, it is advisable to maintain a board that includes both experienced directors with extensive knowledge of the company’s businesses, as well as newer directors who can refresh the board’s collective experience and expertise as business needs require. The board, as well as each of its committees, circulates to its members on an annual basis, a performance assessment questionnaire. The results of the assessment are reviewed by the respective committees, with a view toward taking action to address issues presented. The Governance Committee assesses the contributions of each director annually, and determines the skill set required for new members joining the board. The average tenure of our board members is approximately 11 years.

Role of the Board of Directors in Risk Oversight

The board of directors is responsible for oversight of the risk assessment and risk management process. Management is responsible for risk management, including identification and mitigation planning. The company established thean enterprise risk management process to identify, assess, monitor and address risks across the entire company and its business operations. The description, assessments, mitigation plan and status for each enterprise risk are developed and monitored by management, including management “risk owners” and an oversight management risk committee.

Both the Audit Committee and the entire board review on an ongoing basis the structure of the company’s enterprise risk management program, including the overall process by which management identifies and manages risks. Upon the recommendation of the Governance Committee, the board of directors assigns oversight responsibility for each of the identified enterprise-wide risks to either a specific committee of the board, or to the full board. In addition to theThe board and each committee, with the exception of the Executive Committee, isare responsible for oversight of one or more risks. In 2016, the Audit Committee amended its Charter to formalize its oversight of the Information Technology function generally, and cybersecurity in particular. The assignments are generally made based upon the type of enterprise risk and the

linkage of the subject matter to the responsibilities of the

committee as described in its charter or the nature of the enterprise risk warranting review by the full board. For example, the Finance Committee oversees risks relating to liquidity, and the Audit Committee oversees risks relating to internal controls. controls and the Executive Compensation Committee reviews risk analyses relating to the Company’s compensation programs. With respect to cybersecurity, members of management from multiple disciplines in the company, including Information Technology, Research and Development, Legal and Privacy and Internal Audit provide a detailed overview to the full board of the company’s efforts regarding cybersecurity. Additionally, the enterprise risks that relate to cybersecurity are presented to the Audit Committee in further detail at Audit Committee meetings.

Each enterprise risk and its related mitigation plan is reviewed by either the board of directors or the designated board committee on an annual basis. The Audit Committee is responsible for overseeing and reviewing on an ongoing basis the overall process by which management identifies and manages risks. On an annual basis, the board of directors receives a report on the status of all enterprise risks and their related mitigation plans.

Management monitors the risks and determines, from time to time, whether new risks should be considered either due to changes in the external environment,

| 10 |

CORPORATE GOVERNANCE

changes in the company’s business, or for other reasons. Management also determines whether previously identified risks should be combined with new or emerging risks.

Over the course of the year, management presents to the board for discussion purposes, the company’s overall strategic plan, as well as the strategic plan for each business unit.

CORPORATE GOVERNANCE

The board of directors conducts an annual review of the independence of each director under the New York Stock Exchange listing standards and our standards of independence, which are set forth in the Governance Principles of the Board of Directors available on our website atwww.pb.comwww.pitneybowes.com under the caption “Our Company—Our Leadership & Governance—Corporate Governance.” In making these determinations, the board of directors considers, among other things, whether any director hasor the director’s immediate family members have had any direct or indirect material relationship with Pitney Bowes or its management, including

current or past employment with Pitney Bowes or its independent accountants by the director or the director’s immediate family members.accountants.

Based upon its review, the board of directors has concluded in its business judgment that the following directors are independent: Linda G. Alvarado, Anne M. Busquet, Roger Fradin, Anne Sutherland Fuchs, S. Douglas Hutcheson, Eduardo R. Menascé, Michael I. Roth, Linda S. Sanford, David L. Shedlarz, and David B. Snow, Jr. In addition, the board of directors previously determined that Rodney C. Adkins, James H. Keyes and Robert E. Weissman, who served on the board until May 2013, were independent.

Marc B. Lautenbach is not independent because he is a Pitney Bowes executive officer.

Communications with the Board of Directors

Stockholders and other interested parties may communicate with the Non-Executive Chairman of the board via e-mail at boardchairman@pb.com, the Audit Committee chair via e-mail at audit.chair@pb.com or they may write to one or more directors, care of the Corporate Secretary, Pitney Bowes Inc., 1 Elmcroft Road, MSC 65-19,3001 Summer Street, Stamford, CT 06926-0700.

The board of directors has instructed the corporate secretaryCorporate Secretary to assist the Non-Executive Chairman, Audit Committee chair and the board in reviewing all electronic and written communications, as described above, as follows:

| (i) | Customer, vendor or employee complaints or concerns are investigated by management and copies are forwarded to the Chairman; | |

| (ii) | If any complaints or similar communications regarding accounting, internal accounting controls or auditing matters are received, they will be forwarded by the |

to the Audit Committee chair for review and copies will be forwarded to the Chairman. Any such matter will be investigated in accordance with the procedures established by the Audit Committee; and

| to the Audit Committee chair for review and copies will be forwarded to the Chairman. Any such matter will be investigated in accordance with the procedures established by the Audit Committee; and | |

| (iii) | Other communications raising matters that require investigation will be shared with appropriate members of management in order to permit the gathering of information relevant to the directors’ review, and will be forwarded to the director or directors to whom the communication was addressed. |

Except as provided above, the corporate secretaryCorporate Secretary will forward written communications to the full board of directors or to any individual director or directors to whom the communication is directed unless the communication is threatening, illegal or similarly inappropriate. Advertisements, solicitations for periodical or other subscriptions, and other similar communications generally will not be forwarded to the directors.

| 11 |

CORPORATE GOVERNANCE

Board Committees and Meeting Attendance

During 2013,2016, each director attended at least 75% of the total number of board meetings and meetings held by the board committees on which he or she served. The board of directors met tenseven times in 2013,2016, and the independent directors met in executive session, without any member of management in attendance, sevensix times. MembersEach member of the board of directors serveserves on one or more of the five standing committees described below. As the need arises, the board may establish ad hoc committees of the board to consider specific issues. Mr. Lautenbach is a member of the Executive Committee.

The members of all other board committees are independent directors pursuant to New York Stock Exchange independence standards. Each committee of the board operates in accordance with a charter. The members of each of the board committees are set forth in the following chart.

It is the longstanding practice and the policy of the board of directors that the directors attend the annual meeting of stockholders. All directors then serving on the board attended the May 20132016 annual meeting.

CORPORATE GOVERNANCE

| Name | Audit | Executive | Executive Compensation(1) | Finance | Governance | ||||||

| Linda G. Alvarado | X | X | |||||||||

| Anne M. Busquet | X | X | |||||||||

| Roger Fradin | X | X | |||||||||

| Anne Sutherland Fuchs | X | X | |||||||||

| S. Douglas Hutcheson | X | X | |||||||||

| Marc B. Lautenbach | X | ||||||||||

| Eduardo R. Menascé | X | Chair | X | ||||||||

| Michael I. Roth | X | Chair | Chair | ||||||||

| David L. Shedlarz | Chair | X | X | ||||||||

| David B. Snow, Jr. | X | X | Chair | ||||||||

| Number of meetings in 2013 | 6 | 0 | 11 | 4 | 6 | ||||||

| Executive | ||||||

| Name | Audit | Executive | Compensation | Finance | Governance | |

| Linda G. Alvarado | X | X | ||||

| Anne M. Busquet | X | X | ||||

| Roger Fradin | X | X | ||||

| Anne Sutherland Fuchs | X | X | ||||

| S. Douglas Hutcheson | X | X | ||||

| Marc B. Lautenbach | X | |||||

| Eduardo R. Menascé | X | Chair | X | |||

| Michael I. Roth | X | Chair | Chair | |||

| Linda S. Sanford | X | X | ||||

| David L. Shedlarz | Chair | X | X | |||

| David B. Snow, Jr. | X | X | Chair | |||

| Number of meetings in 2016 | 7 | 0 | 8 | 5 | 6 | |

The Audit Committee monitors our financial reporting standards and practices and our internal financial controls to confirm compliance with the policies and objectives established by the board of directors and oversees our ethics and compliance programs. The committee appoints independent accountants to conduct the annual audits, and discusses with our independent accountants the scope of their examinations, with particular attention to areas where either the committee or the independent accountants believe special emphasis should be directed. The committee reviews the annual financial statements and independent accountant’s report, invites the independent accountant’s recommendations on internal controls and on other matters, and reviews the evaluation given and corrective action taken by management. It reviews the independence of the independent accountants and approves their fees. It also reviews our

internal accounting controls and the

scope and results of our internal auditing activities, and submits reports and proposals on these matters to the board. The committee is also responsible for overseeing the process by which management identifies and manages the company’s risks. The committee meets in executive session with the independent accountants and internal auditor at each committee meeting.

The Audit Committee also has oversight over the information technology function, cybersecurity risks as well as compliance generally.

The board of directors has determined that the following members of the Audit Committee S. Douglas Hutcheson, Michael I. Roth and David L. Shedlarz are “audit committee financial experts,” as that term is defined by the SEC.SEC: S. Douglas Hutcheson, Michael I. Roth and David L. Shedlarz. All Audit Committee members are independent as independence for audit committee members is defined inunder the New York Stock Exchange standards.

The Executive Committee can act, to the extent permitted by applicable law and the company’s Restated Certificate of Incorporation and its By-laws, on matters concerning management of the business which may arise between scheduled board of directors meetings and as described in the committee’sCommittee’s charter. The Committee meets on an ad hoc basis when circumstances necessitate.

| 12 |

CORPORATE GOVERNANCE

Executive Compensation Committee

The Executive Compensation Committee is responsible for our executive compensation policies and programs. The committeeCommittee chair frequently consults with, and the committeeCommittee meets in executive session with, Pay Governance LLC, its independent compensation consultant. The committeeCommittee recommends to all of the independent directors for final approval policies, programs and specific actions regarding the compensation of the CEO and the Chief Operating Officer (COO), and approves the

same for all of our other executive of-

ficers.officers. The committeeCommittee also recommends the “Compensation Discussion and Analysis” for inclusion in our proxy statement, in accordance with the rules and regulations of the SEC, and reviews and approves stock grants and other stock-based compensation awards. All Executive Compensation Committee members are independent as independence for compensation committee members is defined in the New York Stock Exchange standards.

CORPORATE GOVERNANCE

The Finance Committee reviews our financial condition and capital structure, and evaluates significant financial policies and activities, oversees our major retirement programs, advises management and recommends financial action to the board of directors. The committee’sCommittee’s duties include monitoring our current and projected financial condition, reviewing and recommending for board approval quarterly dividends, share repurchases,

board approvaland other major investment decisions including financing, mergers and acquisitions, divestitures and overseeing the financial operations of our retirement plans. The committeeCommittee recommends for approval by the board of directors the establishment of new retirement and post-retirement benefit plans and any amendments that materially affect cost, benefit coverages, or liabilities of the plans.

The Governance Committee recommends nominees for election to the board of directors, recommends membership in, and functions of, the board committees, reviews and recommends to the board of directors the amount and form of compensation to non-employee members of the board, and with the Non-Executive Chairmanoversees CEO and the CEO, is responsible for CEOsenior management succession planning and ensuring management continuity.planning. The Governance Principles of the Board of Directors, which are posted on our website atwww.pb.comwww.pitneybowes.com under the caption “Our Company—Leadership &Meet Our Leaders—Corporate Governance,” include additional information about succession planning. The committeeCommittee reviews and evaluates the effectiveness of board administration and its governing documents, and reviews and monitors company programs and policies relating to directors. The committeeCommittee reviews related-person transactions in accordance with company policy.

The Governance Committee generally identifies qualified candidates for nomination for election to the board of directors from a variety of sources, including other board members, management and stockholders. The committeeCommittee also may retain a third-party search firm to assist the committeeCommittee members in identifying and evaluating potential nominees to the board of directors.

Stockholders wishing to recommend a candidate for consideration by the Governance Committee may do so by writing to: c/o Corporate Secretary, Pitney Bowes Inc., 1 Elmcroft Road, MSC 65-19,3001 Summer Street, Stamford, CT 06926-0700. Recommendations submitted for consideration by the committee in preparation for the 2015 annual meeting of stockholders must be received by January 5, 2015, and must contain the following information: (i) the name and address of the stockholder; (ii) the name and address of the person to be nominated; (iii) a representation that the stockholder is a holder of our stock entitled

to vote at the meeting; (iv) a statement in support of the stockholder’s recommendation, including a

description of the candidate’s qualifications; (v) information regarding the candidate as would be required to be included in a proxy statement filed in accordance with the rules of the SEC; and (vi) the candidate’s written, signed consent to serve if elected.

The Governance Committee evaluates candidates stockholders recommend based on the same criteria it uses to evaluate candidates from other sources. The Governance Principles of the Board of Directors, which are posted on our Corporate Governance website atwww.pb.comwww.pitneybowes.com under the caption “Our Company—Leadership &Meet Our Leaders—Corporate Governance,” include a description of director qualifications. A discussion of the specific experience and qualifications the committeeCommittee identified for directors and nominees may be found under “Director Qualifications” on page 2319 of this proxy statement.

If the Governance Committee believes that a potential candidate may be appropriate for recommendation to the board of directors, there is generally a mutual exploration process, during which the committeeCommittee seeks to learn more about the candidate’s qualifications, background and interest in serving on the board of directors, and the candidate has the opportunity to learn more about the company, the board, and its governance practices. The final selection of the board’s nominees is within the sole discretion of the board of directors.

Alternatively, as referenced on page 118 of this proxy statement, stockholders intending to nominate a candidate for election by the stockholders at the meeting must comply with the procedures in Article I, Section 5 of the company’s By-laws. The By-laws are posted on our Corporate Governance website atwww.pb.comwww.pitneybowes.com under the caption “Our Company—Our Leadership & Governance—Corporate Governance.”

| 13 |

CORPORATE GOVERNANCE

The Governance Committee assesses the contributions of each director annually, and determines the skill set for new board members. Each committee also conducts an annual self-assessment of its performance. The

board also periodically hires an outside advisor to conduct an independent review of board effectiveness, and it did so in 2016.

Role of Governance Committee in Determining Director Compensation

In accordance with the Governance Principles of the board, the Governance Committee reviews and recommends to the board of directors the amount and form of compensation to non-employee members of the board of directors. The Governance Committee reviews the director compensation policy periodically and may consult from time to time with a compensation consultant, to be selected and retained by the Committee, as to the competitiveness of the program.

The non-employee directors’ compensation program was last revised effective in May 2014. In connection

with its 2014 revision, the Governance Committee retained an independent compensation consultant with no other company business, Farient Advisors, to assist in its review of the director compensation program.

To date, the Governance Committee has set director compensation levels at approximately the 50th percentile of the total compensation in the peer and broader benchmark groups. The revised board compensation program became effective on May 12, 2014, when the company’s stockholders approved the amended and restated Directors’ Stock Plan.

Highlights of the Directors’ Compensation Program:

| • | Cash component paid as an annual retainer | |

| • | Leadership premiums paid to Committee Chairmen | |

| • | Leadership premium paid to Chairman of the board | |

| • | Annual equity grant in the form of restricted stock units, the number of which is calculated by dividing $100,000 by the fair market value of a share of the company’s common stock as of the award date | |

| • | Each non-employee director is subject to a stock ownership requirement equal to five times the annual cash retainer, $375,000, to be attained over a five-year period |

Directors’ Fees

During 2013, eachEach non-employee director who was not an employee receivedreceives an annual retainer of $65,000$75,000 for board service and a meeting feean additional retainer for service on the committees to which he or she is assigned. The Non-Executive Chairman of $1,500the Board receives an additional retainer of $100,000 commensurate with the additional responsibilities required of the chairman role.

Annual retainers for each board and committee meeting attended. Committee chairs (exceptservice are: $12,000 for service on the Audit Committee chair) receive an additional $1,500 for each committee meeting that they chair, and(with the Audit Committee chair receives an additional $2,000 for each Audit Committee meeting chaired.

The Non-Executive Chairman receivesreceiving an additional annual retainer of $50,000. $12,000); $10,500 for service on the Executive Compensation Committee (with the Committee Chairman receiving an additional annual retainer of $10,500);

$9,000 for service on the Governance Committee (with the Committee Chairman receiving an additional annual retainer of $9,000); and $9,000 for service on the Finance Committee (with the Committee Chairman receiving an additional annual retainer of $9,000).

A meeting attendance fee of $2,000 is paid with respect to meetings of the Executive Committee. The Executive Committee did not meet in 2016.

All directors are reimbursed for their out-of-pocket expenses incurred in attending board and committee meetings.

The board of directors maintains directors’ stock ownership guidelines, requiring, among other things, that each director accumulate and retain a minimum of 7,500

CORPORATE GOVERNANCE

shares of our common stock within five years of becoming a director of Pitney Bowes. The stock ownership guidelines provide limited exceptions for the transfer of these shares while the director continues to serve on our board, as discussed in more detail under “Directors’

Stock Plan” below. All members of the board of directors are in compliance with these guidelines. The directors’ stock ownership guidelines are available on our Corporate Governance website atwww.pb.com under the caption “Our Company—Leadership & Governance.”

Directors’ Stock Planunder the Director’s Compensation Program

Under the amended and restated Directors’ Stock Plan, in 2013 each non-employee director who was not an employee of the company received an award of 2,200 sharesrestricted stock units with a fair market value of restricted stock$100,000 on the date of grant, which are fully vested one year after six months from the date of grant. (Directors appointed by the board to fill a vacancy during the year receive a prorated grant of sharesrestricted stock units as described in the Directors’ Stock Plan.) The units have no voting rights until they are converted to shares carry full voting andof common stock. Each non-employee director receives a quarterly cash payment equal to the amount that would have been paid

as a dividend rights upon grant but, unless certain conditions are met,with respect to shares represented by the restricted stock units held as of the record date for the payment of the common stock dividend. Non-employee directors may not be transferred or soldelect to defer the conversion of restricted stock units to shares until the laterdate of (i) termination of service as a director, or, if earlier, the date of a change of control (as defined in the Directors’ Stock Plan), and (ii) the expiration of the six-month period following the grant of such shares. The Directors’ Stock Plan permits certain dispositions of stock granted under the restricted stock program provided that the di-

rector effecting the disposition had accumulated and will retain 7,500 shares of common stock. Permitted dispositions are limited to: (i) transfer to a family member or family trust or partnership; and (ii) donations to charity after the expiration of six months from date of grant. The original restrictions would continue to apply to the donee except that a charitable donee would not be bound by the restriction relating to termination of service from the board of directors.director.

Shares shown in the table on page 2117 of this proxy statement disclosing security ownership of directors and executive officers include shares granted to the directors under the Directors’ Stock Plan.

| 14 |

CORPORATE GOVERNANCE

Director Stock Ownership Requirement

The board of directors maintains directors’ stock ownership guidelines, requiring, among other things, that each director accumulate and retain a minimum of company common stock with a market value of five times the base retainer, or $375,000, within five years of becoming a director of Pitney Bowes. All members of

the board of directors are currently in compliance with these guidelines. The directors’ stock ownership guidelines are available on our Corporate Governance website atwww.pitneybowes.com under the caption “Our Company—Our Leadership & Governance—Corporate Governance.”

Directors’ Deferred Incentive Savings Plan

We maintain a Directors’ Deferred Incentive Savings Plan under which directors may defer all or part of the cash portion of their compensation. Deferred amounts will be notionally “invested” in any combination of sev-

eral institutional investment funds. The investment choices available to directors under this plan are the same as those offered to employees under the company’s 401(k) plan.

Directors’ Equity Deferral Plan

Directors may elect to defer all of their equity portion of their compensation on an annual basis. Deferral of restricted stock units (RSU) defers settlement of the RSU into company common stock until termination from board service. RSU awards, whether deferred or not, vest on the first anniversary of the award. Deferred

RSUs continue to receive dividend equivalents. Deferred RSUs do not have any voting rights until converted into common stock. Deferred RSUs are converted into company common stock upon the expiration of 90 days following termination of board service.

Directors’ Retirement Plan

The board discontinued the Directors’ Retirement Plan, with all benefits previously earned by directors frozen as of May 12, 1997.

Linda G. Alvarado is the only current director who is eligible to receive a retirement benefit under the plan after termination of service on the board of directors. As of

of the date the plan was frozen, she had completed five years of service as a director, the minimum years of service required to receive an annual retirement benefit of 50% of her retainer as of May 12, 1997. Therefore, she will receive an annual benefit of $15,000.$15,000 after termination from board service.

CORPORATE GOVERNANCE

DIRECTOR COMPENSATION FOR 20132016

| Name | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(2) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($)(3) | All Other Compensation ($)(4) | Total ($) | |||||||||||||||||

| Rodney C. Adkins(5) | 34,875 | 0 | 0 | 0 | 34,875 | |||||||||||||||||

| Linda G. Alvarado | 96,500 | 33,363 | 0 | 0 | 129,863 | |||||||||||||||||

| Anne M. Busquet | 98,000 | 33,363 | 0 | 0 | 131,363 | |||||||||||||||||

| Roger Fradin | 93,500 | 33,363 | 0 | 5,000 | 131,863 | |||||||||||||||||

| Anne Sutherland Fuchs | 105,500 | 33,363 | 0 | 5,000 | 143,863 | |||||||||||||||||

| S. Douglas Hutcheson | 95,000 | 33,363 | 0 | 5,000 | 133,363 | |||||||||||||||||

| James H. Keyes(5) | 40,875 | 0 | 0 | 0 | 40,875 | |||||||||||||||||

| Eduardo R. Menascé | 119,000 | 33,363 | 0 | 0 | 152,363 | |||||||||||||||||

| Michael I. Roth | 160,000 | 33,363 | 0 | 5,000 | 198,363 | |||||||||||||||||

| David L. Shedlarz | 107,000 | 33,363 | 0 | 0 | 140,363 | |||||||||||||||||

| David B. Snow, Jr. | 108,500 | 33,363 | 0 | 0 | 141,863 | |||||||||||||||||

| Robert E. Weissman(5) | 40,875 | 0 | 0 | 0 | 40,875 | |||||||||||||||||

| Name | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(2) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($)(3) | All Other Compensation ($)(4) | Total ($) | |||||||||||||||

| Linda G. Alvarado | 93,000 | 100,000 | 11,231 | 6,388 | 210,619 | |||||||||||||||

| Anne M. Busquet | 94,500 | 100,000 | 0 | 11,388 | 205,888 | |||||||||||||||

| Roger Fradin | 96,000 | 100,000 | 0 | 13,911 | 209,911 | |||||||||||||||

| Anne Sutherland Fuchs | 94,500 | 100,000 | 0 | 3,911 | 198,411 | |||||||||||||||

| S. Douglas Hutcheson | 96,000 | 100,000 | 0 | 9,250 | 205,250 | |||||||||||||||

| Eduardo R. Menascé | 105,000 | 100,000 | 0 | 9,250 | 214,250 | |||||||||||||||

| Michael I. Roth | 205,000 | 100,000 | 0 | 11,411 | 316,411 | |||||||||||||||

| Linda S. Sanford | 97,500 | 100,000 | 0 | 4,842 | 202,342 | |||||||||||||||

| David L. Shedlarz | 108,000 | 100,000 | 0 | 6,388 | 214,388 | |||||||||||||||

| David B. Snow, Jr. | 103,500 | 100,000 | 0 | 6,773 | 210,273 | |||||||||||||||

| (1) | Each non-employee director receives an annual retainer of | $100,000 ($25,000 per quarter). Each committee member receives the following annual retainer: $12,000 for Audit,$10,500 for Executive Compensation and $9,000 each for Finance and Governance. The committee chairmen receive an additional retainerof equal amounts for their respective committees. | |

| (2) | 2016. See Note 21 “Stock-Based Compensation” in the Notes to our ConsolidatedFinancial Statements included in our Annual Report on Form 10-K for the year ended December 31, 2016 for the valuation assumptionsused in determining the fair value of equity grants. | ||

| (3) | Ms. Alvarado is the only non-employee director who served on the board of directors during | in 2016 is primarily driven by the decrease in discount rate (from 4.55% at December 31, 2015 to 4.20% at December 31, 2016) and the one year decrease in the deferral period. | |

| (4) | During 2016, dividend equivalents were paid quarterly in cash to non-employee directors with respect to (a) the first quarter on the awardof 4,403 restricted stock units granted in May 2015 and (b) the second, third and fourth quarter on the 5,485 restricted stock units grantedin May 2016. In addition, with respect to Mmes. Alvarado and Busquet and Messrs. Hutcheson, Menascé and Snow, dividend equivalentswere paid with respect to the vested restricted stock units previously deferred. Ms. | ||

| charitable contribution. |

Role of Governance Committee in Determining Director Compensation

In accordance with the Governance Principles of the Board, the Governance Committee reviews and recommends to the board of directors the amount and form of compensation to non-employee members of the board of directors. The Governance Committee reviews the di-

rector compensation policy periodically and may consult from time to time with a compensation consultant, to be selected and retained by the committee, as to the competitiveness of the program.

Revised Director Compensation Program

The Governance Committee undertook a review of director compensation in 2013. The compensation for the board of directors was last modified in 2007. The Governance Committee retained an independent compensation consultant, Farient Advisors, to assist in its review. Farient provides no other consulting services to the company.

Farient presented a recommendation to the Governance Committee for changes to the board of directors compensation program, based upon an extensive analysis of comparative data, including director compensation at companies in the peer group used for executive com-

pensation purposes. Farient concluded that the company’s director compensation was below market, particularly in the equity component of the program, when compared with the peer group and the broader benchmark of comparably sized companies.

Based upon its review, including the information Farient provided, the Governance Committee recommended that the board of directors approve changes to the director compensation program. The Governance Committee recommended that the compensation level be set at about the 50th percentile of the total compensation in the peer and broader benchmark groups. The board of

CORPORATE GOVERNANCE

directors approved the changes to the compensation program, subject to the approval by our stockholders of an amended and restated Directors’ Stock Plan. No new

shares need to be authorized to satisfy awards under the amended and restated Directors’ Stock Plan.

A comparison of the current directors’ compensation program and the new program is shown in the table below.

COMPARISON OF CURRENT AND NEW DIRECTOR COMPENSATION PROGRAMS

| Incremental Leadership | ||||||||||||||||||

| Board Member | Premiums | |||||||||||||||||

| Compensation Element | Current | New | Current | New | ||||||||||||||

| Board service | (Board Chairman) | |||||||||||||||||

| Cash retainer | $65,000 | $75,000 | $50,000 | $100,000 | ||||||||||||||

| Meeting fee | $1,500 | $0 | $0 | $0 | ||||||||||||||

| Equity Award | 2,200 shares | $100,000 | ||||||||||||||||

| Annual Equity Grant | value-based grant | |||||||||||||||||

| Committee service | Committee | |||||||||||||||||

| Cash retainer | Chairmen | |||||||||||||||||

| • Audit | $0 | $12,000 | $0 | $12,000 | ||||||||||||||

| • Executive Compensation | $0 | $10,500 | $0 | $10,500 | ||||||||||||||

| • Governance | $0 | $9,000 | $0 | $9,000 | ||||||||||||||

| • Finance | $0 | $9,000 | $0 | $9,000 | ||||||||||||||

| Meeting Fee | ||||||||||||||||||

| • Audit | $1,500 | $0 | $2,000 | $0 | ||||||||||||||

| • Executive Compensation | $1,500 | $0 | $1,500 | $0 | ||||||||||||||

| • All Other Committees | $1,500 | $0 | $1,500 | $0 | ||||||||||||||

| Total Compensation | @$125,000 | @$195,000 | ||||||||||||||||

| Ownership Guidelines | 7,500 shares; | 5 times cash retainer; | ||||||||||||||||

| 5 years to reach | 5 years to reach | |||||||||||||||||

| compliance | compliance | |||||||||||||||||

Highlights of the Revised Directors’ Compensation Program are:

A meeting attendance fee of $2,000 will be paid with respect to meetings of the Executive Committee. The Executive Committee did not meet in 2013.

CORPORATE GOVERNANCE

Relationships and Related-Person Transactions

The board of directors has a written “Policy on Approval and Ratification of Related-Person Transactions” which states that the Governance Committee is responsible for reviewing and approving any related person transactions between Pitney Bowes and its directors, nominees for director, executive officers, beneficial owners of more than five percent of any class of Pitney Bowes voting stock and their “immediate family members” as defined by the rules and regulations of the SEC (related persons).

Under the related-person transaction approval policy, any newly proposed transaction between Pitney Bowes and a related person must be submitted to the Governance Committee for approval if the amount involved in the transaction or series of transactions is greater than $120,000. Any related-person transactions that have not been pre-approved by the Governance Committee must be submitted for ratification as soon as they are identified. Ongoing related-person transactions are reviewed on an annual basis. The material facts of the transaction and the related person’s interest in the transaction must be disclosed to the Governance Committee. It is the

expectation and policy of the board of directors that any related-person transactions will be at arms’ length and on terms that are fair to the company.

If the proposed transaction involves a related person who is a Pitney Bowes director or an immediate family member of a director, that director may not participate in the deliberations or vote regarding approval or ratification of the transaction but may be counted for the purposes of determining a quorum.

The following related-person transactions do not require approval by the Governance Committee:

| 1. | Any transaction with another company with which a related person’s only relationship is as an employee or beneficial owner of less than ten percent of that company’s shares, if the aggregate amount invested does not exceed the greater of $1 million or two percent of that company’s consolidated gross revenues; |

| 2. | A relationship with a firm, corporation or other entity that engages in a transaction with Pitney Bowes where the related person’s interest in the transaction |

| 16 |

CORPORATE GOVERNANCE

arises only from his or her position as a director or limited partner of the other entity that is party to the transaction;

| 3. | Any charitable contribution by Pitney Bowes to a charitable organization where a related person is an officer, director or trustee, if the aggregate amount involved does not exceed the greater of $1 million or two percent of the charitable organization’s consolidated gross revenues; |

| 4. | Any transaction involving a related person where the rates or charges involved are determined by competitive bids; and |

| 5. | Any transaction with a related person involving services as a bank depositary of funds, transfer agent, registrar, trustee under a trust indenture, or similar services. |

The Governance Committee may delegate authority to approve related-person transactions to one or more of its members. The member to whom such authority is delegated must report, for informational purposes only, any approval or ratification decisions to the Governance Committee at its next scheduled meeting.

During 2013, the company2016, no transactions were submitted one transaction to the Governance Committee for review and ratification. Abby F. Kohnstamm was appointed Executive Vice President and Chief Marketing Officer, effective as of June 17, 2013. Prior to the effective date of her appointment as Chief Marketing Officer, on February 1, 2013, Pitney Bowes had entered into a consulting agreement for a period of four months with Abby F. Kohnstamm & Associates, Inc., a marketing consulting firm which Ms. Kohnstamm founded and served as President and Chief Executive Officer. Pitney Bowes paid Abby F. Kohnstamm & Associates, Inc. $200,000 during 2013 under the consulting agreement. The term of the consulting agreement, and all services performed thereunder, ended prior to the effective date of Ms. Kohnstamm’s appointment as Chief Marketing Officer.review.

Compensation Committee Interlocks and Insider Participation

During 2013,2016, there were no compensation committee interlocks and no insider participation in Executive Compensation Committee decisions that were required to be reported under the rules and regulations of the Securities Exchange Act of 1934, as amended.

CORPORATE GOVERNANCE

SECURITY OWNERSHIP OF DIRECTORS AND EXECUTIVE OFFICERS

| Title of Class of Stock | Name of Beneficial Owner | Shares Deemed to be Beneficially Owned(1)(2)(3)(4) | Options Exercisable Within 60 Days(4) | % of Class | |||||||||